At CompareLawsuitLoans.com we’re all about the numbers, but we recognize that math isn’t everyone’s bread-and-butter.

We created this calculator in Google Sheets to help plaintiffs with quotes involving confusing rates and fees make sense of everything. It works best on a desktop but you can still use it on mobile.

If this is your first time using this website, our How to Compare Lawsuit Loans guide might be a good starting point in your hunt for the cheapest lawsuit loan possible.

Opening the lawsuit loan calculator

Click this link to get started with the tool on Google Sheets: Lawsuit Loan Calculator and Comparison Tool

How to open on Android:

- Tap the link above

- Tap the three vertical dots at the top right of the app screen

- Tap “Share & export”

- Tap “Make a copy”

How to open on PC, Mac or iPhone:

- Click or tap the link above

- Click or tap “Make a copy”

Excel version: Lawsuit Loan Calculator and Comparison Tool

Getting comparable quotes from pre-settlement funding companies

There are really three main steps to getting the info you need to use this calculator and comparison tool.

- Determine how much funding you need and read-up on our How to Compare Lawsuit Loans Guide

- Select companies that you want to compare from our list of lawsuit loan companies we review

- Ask the lawsuit funding companies you apply with for firm quotes based on the amount of money you’re looking for. Make sure that they are giving you a quote on that dollar value “in your pocket” – often funding companies will subtract additional fees like delivery fees before sending you the money.

How to use our lawsuit loan calculator

Using our lawsuit loan calculator is easy. When you open it up, you’ll see the default numbers included for four different scenarios.

The light-yellow highlighted cells with blue font are the figures you want to edit and fill with the information you received from the pre-settlement funding company. If you edit other cells, you might break the calculator a little, but you can always reload it from our website.

We recommend that you always get quotes based on the same total lawsuit loan amount that you need to make comparison easy.

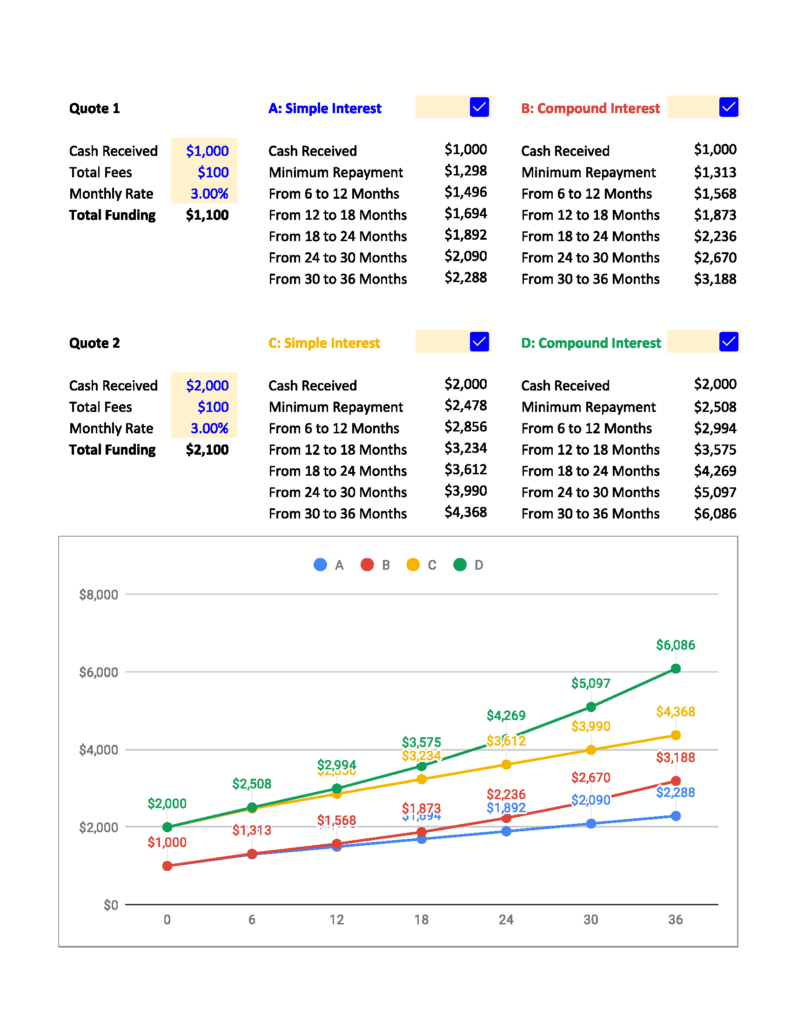

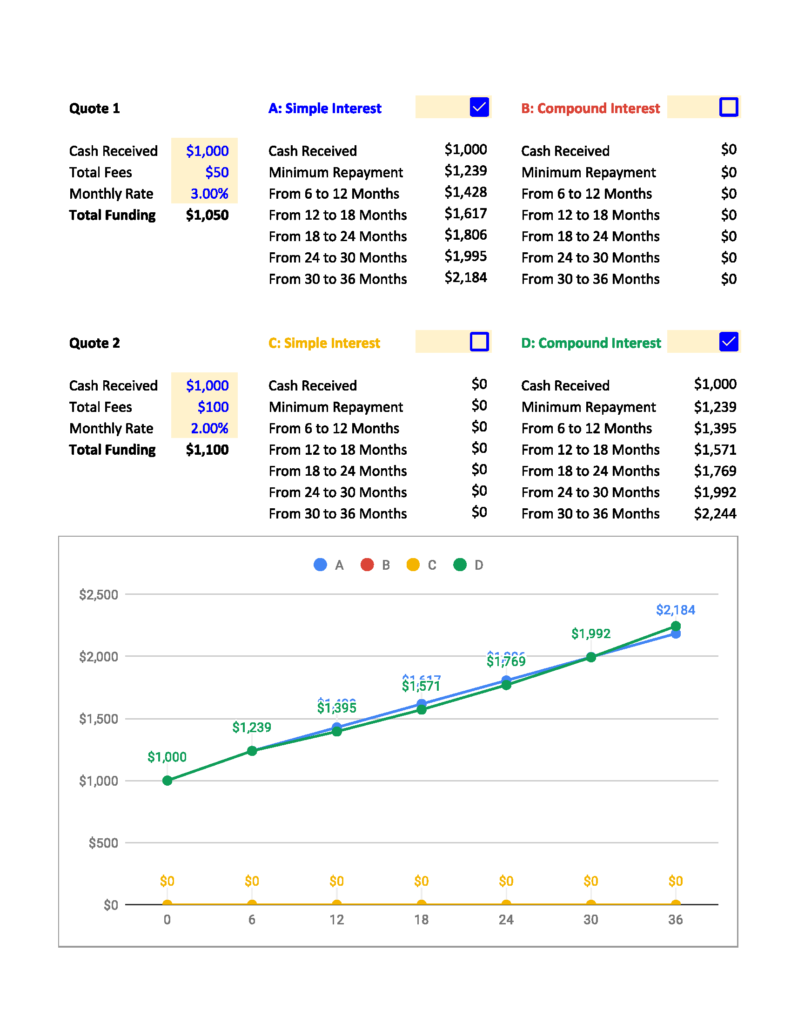

Quote Comparison Example 1

So, for example, let’s say you’re looking for $1,000 dollars. You reach out to two companies and get quotes on a $1,000 lawsuit cash advance. You insist that you want a quote based on getting $1,000 in your pocket after ALL fees, including broker fees, delivery fees, application fees, etc.

Company A quotes you 3% monthly simple interest with $50 of total fees Company B quotes you 2% monthly compounding interest with $100 of total fees. Let’s fill in the data.

As you can see looking at the blue and green lines, even though there is a huge difference in the quoted rate (2% vs. 3%), these quotes are nearly identical in terms of payback!

Quote Comparison Example 2

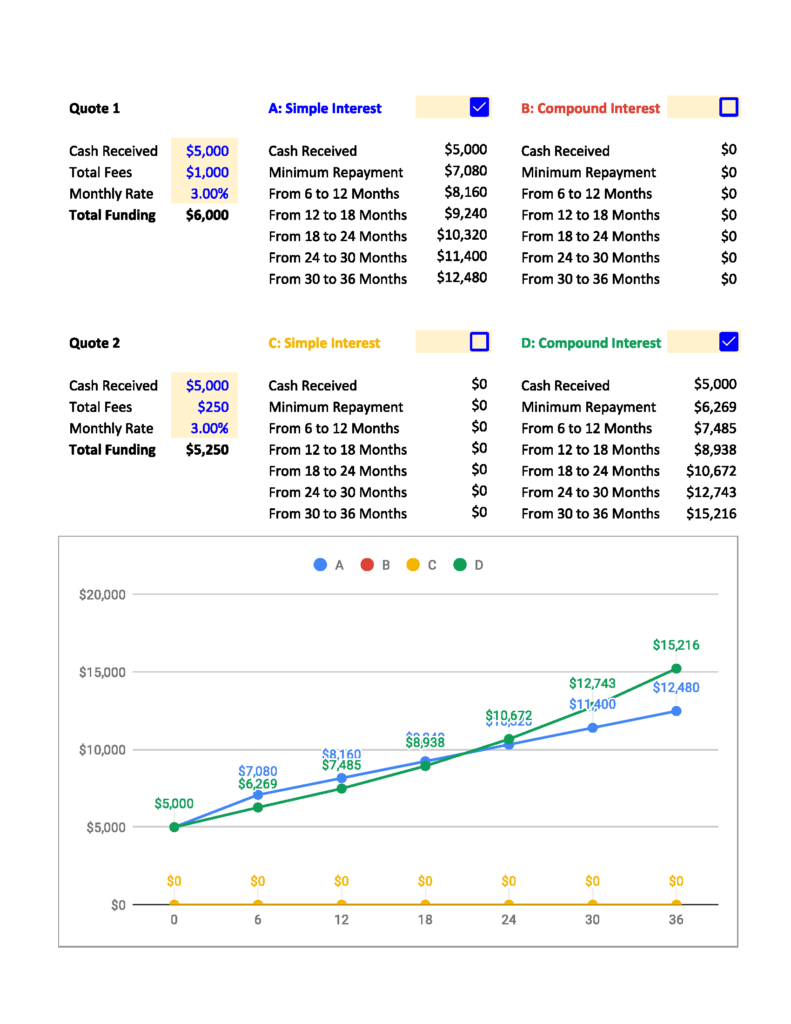

Let’s say you’re looking for $5,000 dollars. You reach out to two companies and get quotes on a $5,000 advance. Again, you insist that you want a quote based on getting $5,000 in your pocket after ALL fees, including broker fees, delivery fees, application fees, etc.

Company A quotes you 3% monthly simple interest with $1,000 of total fees Company B quotes you 3% monthly compounding interest with $250 of total fees. Let’s plug it all in.

In this example, we’re looking at the blue and green lines again. Here we get an interesting result! The cheaper fee makes the compounding rate more competitive for a while (about a year and a half), but then the compounding takes-off. Within another year you’re charged an extra $3,000 on top.

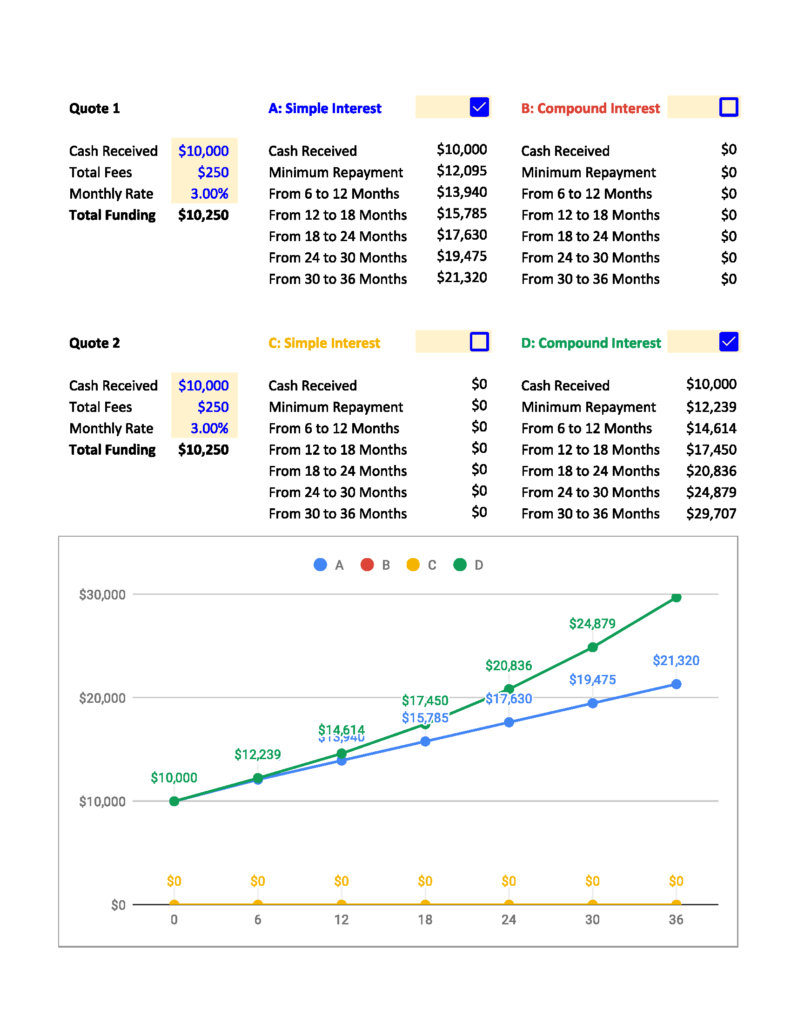

Quote Comparison Example 3

Another example – you’re looking for $10,000. You get quotes from two companies on $10,000 in your pocket.

The companies quote you the same monthly rate, the same fees, but one is charging simple rates and the other compounding. Let’s say $250 in total fees from each. Company A is charging 3% simple and company B is charging 3% compounding.

You can look at the blue and green lines here. This demonstrates the difference between simple and compounding rates if everything else is equal. With the same rates and fees, compounding interest will cost you nearly twice in interest over 36 months.