Injured and need cash?

We give plaintiffs the tools and information they need to make better financial decisions, even when times are tough.

How to shop for lawsuit loans

This guide will teach you how to save thousands on lawsuit loans. This guide will teach you more about:

- Typical lawsuit loan terms, structures, hidden fees, and the fine print

- Quickly narrowing down the endless list of pre-settlement funding companies

- Getting quotes that give you the information you need to compare and make an informed decision

- Comparing and leveraging the quotes you receive to get the best deal possible

Lawsuit loan companies we evaluate

We evaluated dozens of lawsuit loan companies to help you choose. This page and company profiles provide info such as:

- Comprehensive evaluations of some of the largest pre-settlement lawsuit loan companies

- Aggregated customer reviews from various online sources

- Recommended companies that are willing to provide detailed quotes upfront, before you even apply

Resources for personal injury plaintiffs

Here we provide an ever-growing list of resources for injured plaintiffs, including:

- Information on pre-settlement lawsuit loan alternatives

- Budgeting and financial planning tools

- Various resources to help you directly after your accident

- Other resources for personal injury plaintiffs while their case is ongoing

How to Shop for Lawsuit Loans

Updated 02/24/22. This guide will give you the tools to save thousands of dollars on your lawsuit loan with 30 minutes of work

Do you have a lawsuit and need funding for living, medical or litigation expenses? If you need a pre-settlement cash advance, the first thing you should know is that it can be very expensive.

Because there is almost no regulation of the pre-settlement funding industry, you need to do a lot of research before moving forward with any one company. The good news is that if you follow our guide, you will be able to quickly find a solid lawsuit lending company and a fair deal.

Why we made this

We created this guide to give the average plaintiff a better understanding of the industry. The average plaintiff does not know a whole lot about personal injury, let alone purchases and sales of equitable liens in personal injury claims.

Every single day hundreds of plaintiffs are grossly overcharged by lawsuit lending companies. Why? Accident victims don’t have the tools or knowledge necessary to advocate for themselves. We intend to change that.

How do I get the best deal possible? What’s a fair interest rate? How do I avoid being another plaintiff taken advantage of by an under-regulated industry? We’ll provide actionable answers.

This guide will help you become more pre-settlement funding savvy, avoid being overcharged and find the lawsuit cash advance company that best fits your needs.

What is a lawsuit loan?

A lawsuit loan is an advance against the proceeds from an expected settlement. Generally, lawsuit loans are repaid by a plaintiff’s attorney only if the legal case is successful.

Because of that no-win / no-pay structure, your typical lawsuit cash advance isn’t classified as a loan in most states. That means that it is not subject to many regulations from usury laws to the Truth in Lending Act.

Plaintiffs often take out pre-settlement funding to cover living expenses after the accident. As personal injury attorneys are paid on a contingency basis, it is less common to use a lawsuit cash advance for actual lawsuit expenses.

Typically a funding company can advance 5% and 20% of your potential settlement. You can also get funding on your settled case, with some companies offering up to 50% of your share of the settlement.

Benefits of legal loans

There are some potential benefits to taking out a settlement loan on your case.

One of the main benefits of funding is that it gives plaintiffs and attorneys more time. Insurance companies can take advantage of plaintiffs who are out of work and in need of cash urgently by settling for less than a claim is truly worth. With the breathing room provided by settlement loans plaintiffs can complete treatment and, if needed, allow their attorney the time to litigate their case.

Other potential benefits to personal injury loans are:

- Paying for medical expenses that are not covered by health insurance or a letter of protection

- Securing or maintaining transportation to medical appointments

- Maintaining a safe and comfortable residence

Also, unlike other potential financing options, pre-settlement funding comes with a no-win / no-pay structure. That means there is no risk of struggling to pay back your advance. If your case is unsuccessful, you typically owe nothing back.

Disadvantages of lawsuit loans

Lack of regulation

One of the benefits of pre-settlement lawsuit funding is that they are non-recourse (no-win / no-pay). Unfortunately, that means that they do not meet the typical definition of a loan. In most states, they are not regulated in the same way as loans (and they shouldn’t be).

However, this means that in many states lawsuit cash advances are simply not regulated at all. That means that companies are able to charge whatever a consumer is willing to accept.

What makes this worse is that many companies (several industry leaders included) seem to try to make it very difficult to understand the true cost of these advances.

Lawsuit settlement loans are expensive!

No matter how you slice it, pre-settlement loans are more expensive than a typical home mortgage, auto loan, or even the average credit card.

35% annual interest is likely the cheapest rate you will find for pre-settlement funding. Most companies charge substantially more (think 100%+ APR for the average advance). At least one company charges more than 500% interest in the first year.

Lawsuit funding isn’t available to everyone

Not every case qualifies for case advances. Certain case types will not be eligible for funding until they have progressed substantially.

Similarly, residents from certain states will not be able to get funding, due to the state regulations in place.

Overview of lawsuit funding terms

Different loan companies may use different terminology for what is formally called litigation funding. They all ultimately mean the same thing; non-recourse funding on a personal injury case. Some companies say that they provide an “alternative to lawsuit loans” and provide the exact same financial instrument under a different name such as pre-settlement funding or a lawsuit cash advance.

Here are a few terms you need to understand and be aware of:

Interest rates

Interest is the headline figure that you might actually be quoted by a reputable funding company. When asking about interest rates, funding companies will give you a one-sentence answer that gives you very little information. You need to get a specific quote inclusive of all charges, not just a rate range.

- Compounding interest – compounding interest means that you are charged interest on the current amount due, rather than the amount you borrowed. Basically, you are charged interest on the accrued interest. If your case takes a long time to settle, this can have a HUGE impact on your final payback

- Simple, non-compounding interest – with simple interest, you are charged interest on the amount you borrowed only. That means you are not charged interest on accumulated interest, just the cash you received in your pocket (and any one-time fees)

- Multiple-method – often used by companies who don’t want to quote an interest rate at all, the multiple-method usually goes something like this: you owe back 1.5 times what you borrowed before 6 months, 1.8 times what you borrowed after 6 months and before one year, etc. Some companies even use a flat multiple of 2.0 times or 3.0 times regardless of when the advance is repaid.

One-time fees

These fees basically are used so that companies can charge a “lower” rate for marketing purposes. These fees are usually included when interest is assessed. That basically means you pay interest on funds you never received. You should ask that these be waived entirely or reduced substantially.

- Processing fees, application fees, and underwriting fees – charged for processing your advance request and completing the transaction

- Broker fees or origination fees – charged for brokering an application to another funding company

- E-signature fee – fee associated with using a legal funding company’s e-signature service such as DocuSign

- Delivery fee or handling fee – charged for funds delivery. Many companies charge more than the actual cost of the service itself. These fees are often deducted from the amount you actually receive from your funding. Approved for $1,000? You might only get $800 in your pocket after the delivery fee.

Recurring fees

These fees are added to your balance at regular intervals. They purport to cover specific costs that the funding company has. You should ALWAYS ask for these to be waived entirely.

- Archiving or document management fees – these are sometimes charged on a semi-annual or annual basis for maintaining your funding file and are charged for every individual transaction

- Case servicing or case management fees – these are sometimes charged on a semi-annual or annual basis for managing your funding file and are often charged for every individual transaction

Maximum repayment amounts or “caps”

Keep in mind that many companies now provide advances that include a maximum repayment amount or a cap on the amount you will repay. This is extremely helpful if your case happens to take a very long time to settle.

A good rule of thumb is to try to find a company that provides a 2.0x (two-times) cap on repayment. That should mean that you never pay back more than two times the amount you borrowed, in total.

Illustrative examples

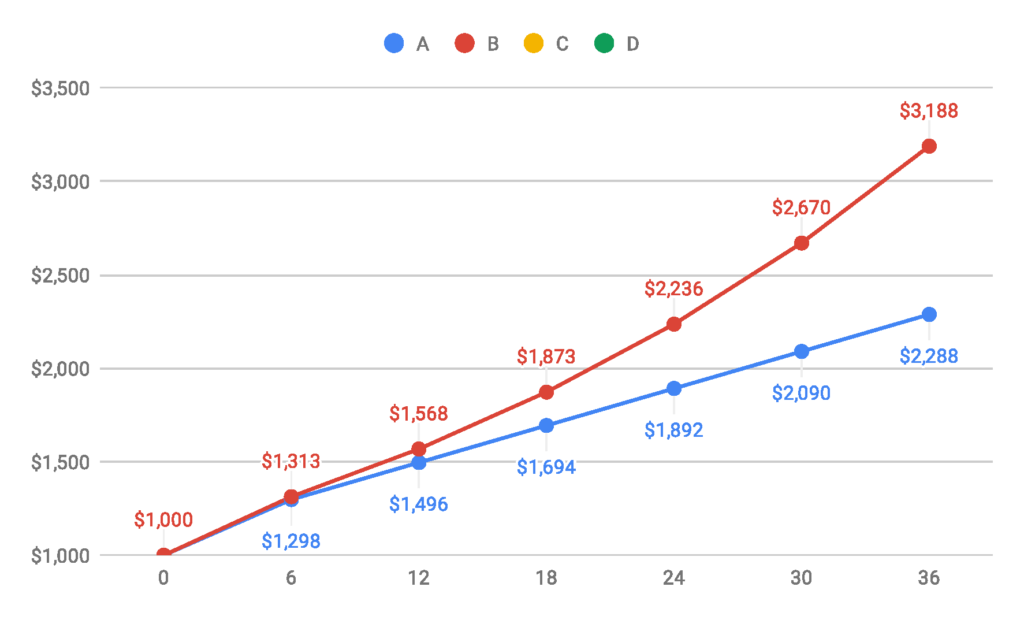

Below are five examples of a typical repayment schedule based on a $1,000 advance. In almost all cases, companies charge interest in six-month increments. However, you only pay back the balance at the conclusion of your case.

The longer your case takes to settle, the more you will pay. Consumers should ask about rates but also be aware of processing fees and the type of interest used. The examples below will illustrate how rates and fees differ.

These payback schedules are the best way to see the cost of your pre-settlement loan because they include the impact of most fees. Note, however, that some companies have some tricks that make apples-to-apples comparison difficult – they will sneak in a three-month bucket or have very high delivery fees so that the money you actually receive is less than the amount you were offered.

Simple interest with fees

Total payback on $1,000 advance, $50 total processing fees, $50 application fee, 3% simple rate

| 0 – 6 months | $1,298 |

| 6 – 12 months | $1,496 |

| 12 – 18 months | $1,694 |

| 18 – 24 months | $1,892 |

| 24 – 30 months | $2,090 |

| 30 – 36 months | $2,288 |

Compound interest with fees

Total payback on $1,000 advance, $50 total processing fees, $50 application fee, 3% monthly compounding interest

| 0 – 6 months | $1,313 |

| 6 – 12 months | $1,568 |

| 12 – 18 months | $1,873 |

| 18 – 24 months | $2,236 |

| 24 – 30 months | $2,670 |

| 30 – 36 months | $3,188 |

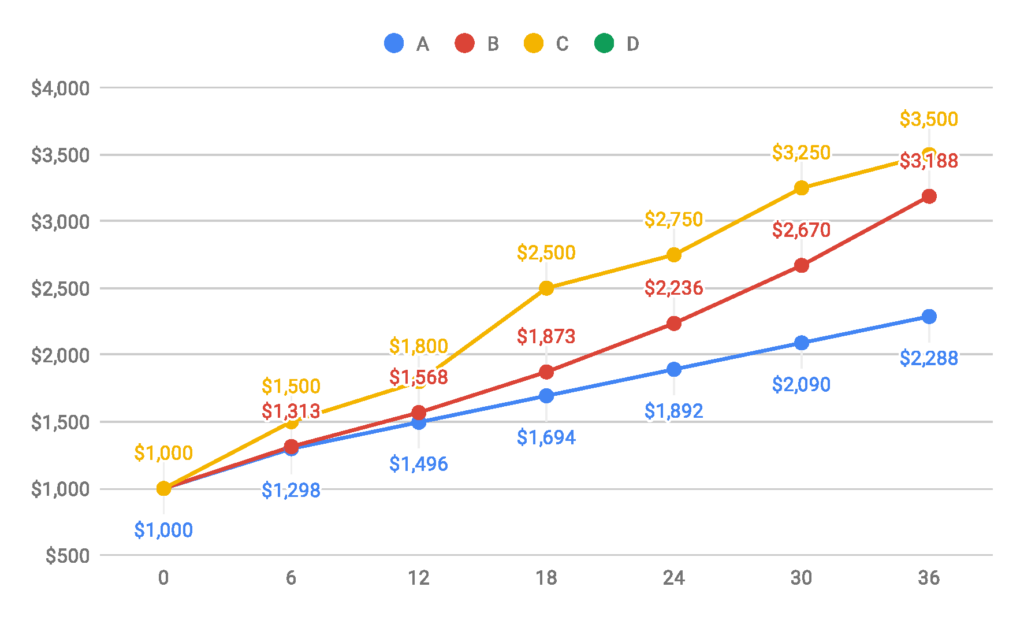

Visualizing simple vs. compound interest, with fees

Using the terms and figures above in our lawsuit loan calculator, we can generate a graph that makes the difference a bit easier to see. Blue line A shows simple interest, and red line B shows compound interest. As you can see, the difference between total payback with simple and compound interest increases over time. By the 30-36 month mark, you owe 70% more in interest with compounding.

Multiple-method (often used by one of the industry leaders)

Total payback on $1,000 advance, multiple-method

| 0 – 6 months | $1,500 |

| 6 – 12 months | $1,800 |

| 12 – 18 months | $2,500 |

| 18 – 24 months | $2,750 |

| 24 – 30 months | $3,250 |

| 30 – 36 months | $3,500 |

Users of the multiple-method make several claims to make it seem more attractive such as claiming they do not charge interest or fees. Be very wary of these claims. If it sounds too good to be true, it is. Check out how the multiple-method stacks up to the other two.

Again, blue line A and red line B are simple and compound interest. We added the multiple-method as yellow line C With the multiple-method, you’ll be paying back 95% more in interest by the 30 – 36 month mark as compared to 3% monthly compounded, even including a 10% processing and application fee.

Lawsuit loan alternatives

Before taking out any lawsuit cash advances it is always important to seek out less expensive options first. Even if the rates are simple, you are still selling a portion of your settlement. It is important to consider all options before moving ahead with a pre-settlement loan. Below, we provide some info on a few of the potentially cheaper alternatives to legal funding.

Creating a budget

Before you take out any legal funding you should create a bare-bones budget. Make sure all of your essentials are there: rent, mortgage, utilities, car note, groceries, etc. Be realistic, but it is best to pare down your expenses as much as possible. This way you know exactly how much money you are going to need each month.

Ideally, you can get by without any aid. If you’re unable to create a budget that will get you through the next year, it may be time to look for help. We advise that you try these options before looking for a settlement loan.

Friends and family

Even though it can be hard to ask for money from family or friends, this might be one of your best options.

After you’ve created your budget, try to see if there are any friends or family who can help you make up the shortfall on a monthly basis.

Ideally, you can find one or more friends or family to pledge a few hundred dollars a month to get you through this tough time. They can be repaid when you get your settlement.

Government assistance programs

There are government programs such as SNAP, SSI, and Section 8 that can help.

Supplemental Nutrition Assistance Program (SNAP)

SNAP is the government food program that helps you get a certain amount of money for food per month. Additionally, most charities or churches have food banks that you would be able to attend to meet your grocery needs.

Supplemental Security Income (SSI)

SSI or Supplemental Security Income is for individuals who are older, blind, or disabled. Depending on the severity of the accident you might qualify for SSI. Once you have acquired SSI you can use it to fund all of your needs, such as rent, clothes, food, etc.

Housing Choice Voucher Program (Section 8)

Section 8 is a housing voucher that can reduce the amount of rent you have to pay. You would have to find Section 8 housing and move, but this could be a good strategy to reduce your cost of living if your case may take a long time to settle.

Each of these programs can give you short-term help and long-term financial stability at no additional cost. Start evaluating these options and apply as soon as possible. It may take some time to get approved.

Refinancing your home

If you own a home there is always the option of refinancing your house. In essence, refinancing your home is taking out another loan to pay off the original mortgage. Taking out a mortgage in excess of the value of your existing mortgage is called tapping your home’s equity. You will get a check from the mortgage lender for the difference.

Given the ongoing pandemic, mortgage rates are extremely low. You may be able to refinance your home at a lower rate while making ends meet. Check out this article on Nerdwallet to learn more.

Bank or credit union loans

There is always trying to get a traditional loan from the bank or credit union. These are based on your credit score and employment status.

A national bank or credit union is the safest place to get a traditional loan. These loans will typically come with a lower interest rate than a credit card or payday loan.

However, if you are entirely out of work due to your injury, these may be tough to qualify for.

Bankrate has a wealth of good information on these types of loans.

Non-profit organizations

Last but not least there are non-profit organizations that are created to help people who have been in accidents.

While some of them may be based regionally, it is important to look around your state to see if there are any agencies that can help you.

Ask your lawyer if they have any recommendations based on past experience.

Here’s a good resource to get you started.

Crowd-sourced funding

There are several websites you can use to start a campaign to raise some money. Your extended network or even strangers can donate to your cause.

GoFundMe is one of the biggest companies that provide this service. You can create a campaign in minutes.

How to start your search for a funding company

Below we have detailed what you should do while shopping around for a lawsuit loan. Don’t just go with the first company that you contact. Make sure you get a quote in writing so you can compare that company’s rates to all others. Then see if you can get the company you want to give you a lower rate due to the quotes you’ve received with others.

Remember, these companies want your business – so the ball is in your court. Don’t be bullied into taking a loan with a company just because they say they are the only ones who will fund you.

Finding reputable lawsuit lending companies and making a list

There are a few ways to go about finding the best pre-settlement funding companies. Here, we break down how to do that and what to look for.

- Using this website – we made this website for this exact purpose. We encourage you to use it to find a few reputable companies that you may want to move forward with.

- Using Google and Yelp – you can Google “lawsuit loans” and find more than 100 companies offering a similar service.

- Ask your attorney – you can ask your attorney for their top picks – be sure to ask why they like the companies they recommend.

As you find companies you’re interested in, it is important to keep track of the name of the company, the name of people you speak to at the company, and their contact details.

1. Use Compare Lawsuit Loans to find the company that’s right for you

Compare Lawsuit Loans is designed for plaintiffs to quickly review key facts about many of the companies that provide pre-settlement lawsuit funding. Check out each company and compare them to find the company that might be right for you.

We provide info on Google, Yelp, and BBB reviews, turnaround times, contact details, interest rate information, and many other data points to get you started.

Here’s a full list of the lawsuit funding companies we review and a few funding companies we recommend.

2. Using Google and Yelp

If you want to find more companies that are not listed on this website, you can always use Google and Yelp. Be wary of the fact that many companies only ask for reviews from customers that they know will give them high ratings. Some companies will even try to intimidate reviewers who leave low ratings or pay them off to remove them. In short, always take care to look at the full picture, including doing your own research.

3. Ask your attorney

Sometimes lawyers have companies that they prefer to work with and will refer you to a lawsuit settlement funding company that’s best for them. It is important to make sure that the company is also best for you. You need to ask your attorney (and the company) some follow-up questions to make sure you get a good deal.

Ask your attorney about the rates, what kind of interest they charge (simple, or compounding), and what fees they charge. Remember, simple rates are always going to be cheaper than compounding rates, especially in the long run. Also, you’re going to want a company that has minimal fees so you get the most money in your pocket.

If your attorney states any of the following reasons for wanting you to choose their company, it could be a red flag. You may want to avoid using the company in question:

- “We only work with this company” – this typically means your lawyer has a relationship with the company. If that relationship gets you a better deal, that’s great! Unfortunately, we’ve found that in many cases these relationships are not in the clients’ best interest. Ethically, your attorney should be open to you comparing rates and getting the best deal possible.

- “This company does not require a lot of information” – all companies should ask for documentation on your case. If a company is not reviewing your case fully, they are making up for losses on other cases by charging a higher interest rate. Even if it is more work for your attorney, you want to work with a funding company that is diligent.

- “They will reduce the amount due at settlement” – never sign a contract based on a verbal promise that is contrary to the writing on the page. Focus on the numbers on your contract. If they are 100% likely to reduce the amount due at settlement, why don’t they just incorporate that promise into the contract itself and reduce your rate now, before signing?

Questions to ask a lawsuit loan company

Once you have your list of potential companies, call them and ask them the following questions:

- What are your rates? Ask the company their rates so you can get an idea of what you will have to pay back. Make sure they give you clear numbers and look elsewhere.

- Do you offer simple interest rates or compounding interest rates? Simple rates are typically cheaper than compounding rates over time.

- What are your fees? Each company charges additional fees before sending out funding. Make the company provide documentation that shows all fees including delivery fees.

- Do you price match or offer a lowest-rate guarantee? Some companies offer price matching with better rates if you bring them a contract from a different company.

- Will you contact my attorney? All reputable companies require attorney cooperation for legal funding. If the company answers no you should look elsewhere.

- How quickly can I expect my funds? Each company will have a different time frame from when they can expect to have your funds.

- What documentation does my attorney need to provide? Sometimes you might have some of the documents requested. You will want to make sure all requested documentation is available.

Each company should have clear, concise answers to each of those questions. If they beat around the bush or state that they cannot do anything without your attorney’s information, it may be best to look elsewhere. Shop around for quotes before offering your attorneys’ contact information.

Get quotes before giving out your attorney’s information

Once you have narrowed your list based on the answers to those questions, ask the case manager if they can email you a quote. When comparing companies make sure the quoted amount is the same for each.

Think about how much you need and ask for a quote based on that. Make sure you tell each company the same dollar amount so you can compare costs efficiently.

Confirm that your quote shows what you get in your pocket after all fees (especially delivery fees) are deducted. You might need to tell the company upfront how you will have the funds delivered (e.g. wire, check by mail, etc.) to do so.

Some companies charge more than $100 to deliver funds. Where you thought you would get $1,000, you might end up with $800. You need to avoid these issues when comparing rates.

Ideally, you want each company to provide a sample contract with a payoff table before you apply. Some lawsuit lending companies will refuse to provide complete payoff tables before approval. If that’s the case you can generate one with our lawsuit loan calculator and comparison tool covered in the next section.

If a company flat-out refuses to provide a quote before you apply, don’t apply.

How to compare lawsuit loan offers

Once you have the offers you are going to need to compare them. This may be tricky and might differ depending on what you need. Do you need the funds quickly? Are you only looking for a small amount? Do you need a large amount? How long will it take for your case to settle? These are all questions to consider while comparing.

A note – if any company you speak to only provides loan terms and not a payoff table, we’ve got you covered. Use our lawsuit loan calculator and comparison tool to generate a payoff and chart out the difference between offers.

Compare quotes

Once you have compiled all of your lawsuit settlement funding quotes it’s time to compare them. Below we have given some examples of quotes on $1,000, both compounding and simple interest, with and without fees.

| Lawsuit Advance Terms | 0 – 6 months | 30 – 36 months |

| Compounding 3% monthly w/ fees | $1,313 | $3,188 |

| Simple 3% monthly w/ fees | $1,298 | $2,288 |

| Compounding 3% monthly w/o fees | $1,194 | $2,898 |

| Simple 3% monthly w/o fees | $1,180 | $2,080 |

| Multiple-method (“No Interest”) | $1,500 | $3,500 |

You’ll want to look at the 6-month mark (what you would pay back if your case settled in zero to six months) and the 3-year mark (what you would pay back if your case settled in 30 to 36 months). Do the math to see what the actual interest rate charged is. Which quote is lowest after six months? Is it still the lowest after three years?

If one quote is clearly the lowest, you’ve found your initial pick. If one is lower initially but much higher as time progresses proceed with caution. The company may be using compounding rates.

In either case, you can now leverage these contracts to try and get a better deal elsewhere.

Choose the best offer and then repeat

Now that you have the company with the best quote, shop around again, but this time with that quote.

Ask other companies if they can beat the offered rate. If so, have them send you a written offer. Once you have done this again, compare the quotes once more and decide on which two you like the best.

Moving forward with your pre-settlement funding companies

Next, it’s time to involve your personal injury attorney or law office.

Let your attorney know you’ve chosen a few companies by name

Contact your attorney and let them know that you have received quotes from a few specific companies.

Your law firm may encourage you to apply with a company that they have a relationship with. If they do, you can solicit a quote from the company they prefer as well. Again, just focus on getting the best deal possible for you – not what is best or most convenient for your attorney.

Call the companies and let them know your attorney’s info

Call back the two companies you have chosen and give them your attorney’s information. Once they have your attorney’s information they will request documentation on your case to see if they can approve you.

The review process

At this point in your lawsuit funding quest, your work is done. Now your application will be sent to your attorney’s office and they will need to provide your case information. Once your attorney submits your application, the underwriters will review your claim and get back to you with an offer.

At this point, they will determine if you are approved or not, for how much, and at what terms. They will send you a contract to review and once it is signed by you and your attorney, you will receive your funds.

You and your attorney review the contract

Once the underwriters have finished their review, they will send you a detailed contract. Set time aside to review the contract and make sure the contract aligns with any quote you received. If everything checks out, then you and your attorney can sign the agreement. Congratulations, you have successfully gotten the best rate for your case!

Frequently asked questions

Below we have listed some of the frequently asked questions about legal funding.

You can get a loan on your lawsuit by applying online with one of the agencies listed on this website. Make sure you get written quotes from each company that seems to fit your needs and compare them. After that give the company you want your attorney’s information and start the legal funding process.

Lawsuit funding can be worthwhile if you need money urgently and immediately. While they do purchase a portion of your settlement, they give you the cash that you need to pay your bills now.

The fees associated with lawsuit loans differ from company to company. Typical fees can be categorized as follows:

Interest fees – simple interest, compounding interest, and the multiple-method

One-time fees – application fees, processing fees, underwriting fees, broker or origination fees, e-signature fees, delivery or handling fees

Recurring fees – archiving or document management fees, case servicing or case management fees

See above for a more in-depth breakdown.

Many state bar associations deem it unethical for attorneys to provide loans to their clients, even without any charged interest. Check with your attorney and ask if this is an option for you. Note that in all states the bar forbids attorneys from charging interest on advances to clients. All states allow attorneys hired on a contingency basis to pay for case-related litigation expenses and be reimbursed through your settlement.

You cannot get settlement cash advances without an attorney. This is because your attorney is the person who pays back the loan after the case has closed. This is typically done through the attorneys’ trust account. Claimants do not pay back the advance directly.

Your credit score should have no bearing on whether or not you are funded by a company. The value of your case will help companies determine whether or not you can be funded. Plaintiffs that come across any company that requires a credit check should employ a different company.

Having lawsuit funding can help you get a larger settlement. This is because instead of having to settle for less, your attorney will be able to stay on your case. While the value of your case may be high, insurance companies might try to lowball you. Legal funding will let you pay your bills so your attorney can keep fighting for you